In the ever-evolving world of fintech, one company has stood out as a true game-changer: Square Inc., now known as Block Inc. (NYSE: SQ). This comprehensive FintechZoom SQ stock analysis dives deep into the ratings, performance, and expert reviews of this fintech powerhouse.

Whether you’re a seasoned investor or just dipping your toes into the stock market, understanding SQ stocks could be your key to unlocking profitable investment opportunities in the digital finance realm.

What are SQ Stocks? – Market Performance and Background

Square’s journey from a plucky startup to a fintech behemoth is nothing short of remarkable. Founded in 2009 by Twitter co-founder Jack Dorsey, Square revolutionized the payment industry with its iconic white square card reader. This simple device allowed small businesses to accept credit card payments using their smartphones, leveling the playing field in a world dominated by traditional financial institutions.

But Square didn’t stop there. The company has continuously expanded its arsenal of financial technology solutions, creating a diverse ecosystem that caters to businesses and consumers alike. Here’s a breakdown of Square’s key offerings:

- Square Reader and Point of Sale Systems: The foundation of Square’s business, providing merchants with easy-to-use payment processing tools.

- Cash App: Square’s golden goose, a peer-to-peer payment app that’s evolved into a full-fledged financial platform.

- Square Capital: Offering business loans to merchants based on their sales history.

- Tidal: A music streaming service acquired by Square to explore synergies between artists and financial services.

- Square Online: E-commerce solutions for businesses of all sizes.

This diversification has positioned Square as a leader in the broader fintech landscape, competing with traditional banks, payment processors, and other fintech firms. The company’s ability to innovate and adapt to market needs has been a key driver of its stock performance and revenue growth.

Live SQ Stocks

As of [current date], SQ stock is trading at [current price]. Let’s take a look at some key metrics investors should keep an eye on:

| Metric | Value |

| Market Cap | [current market cap] |

| P/E Ratio | [current P/E ratio] |

| 52-Week Range | [52-week low] – [52-week high] |

| Average Volume | [average volume] |

Compared to major indices and fintech competitors, SQ stock has [outperformed/underperformed] in recent [weeks/months]. This performance can be attributed to [brief explanation of recent market trends or company news].

Key Products and Services

Square

Picture this: a tiny white square transforming mom-and-pop shops into card-accepting powerhouses. That’s Square for you. This game-changer democratized payments, letting even the smallest vendors swipe cards with just a smartphone. No more “cash only” signs or clunky old registers – Square brought the future to every farmer’s market stall and food truck.

Cash App

Remember when splitting the bill meant a headache and a handful of crumpled bills? Cash App said “no more!” This slick little app started as a simple way to zap money to friends, but it’s grown into a financial Swiss Army knife. Now you can stash your paycheck, play the stock market, and even dabble in Bitcoin – all from your phone. It’s like having a bank, broker, and crypto exchange in your pocket.

Afterpay

Block’s latest toy is the “buy now, worry later” service Afterpay. It’s like layaway for the digital age, letting shoppers spread out payments without the nasty interest of credit cards. By scooping up Afterpay, Block’s giving both buyers and sellers more flexibility. It’s a win-win that’s shaking up how we think about buying stuff.

Significance in the Fintech Industry

Block isn’t just playing in the fintech sandbox – it’s building castles. By weaving together payment processing, personal finance, and now “buy now, pay later,” they’ve created a financial ecosystem that’s hard to ignore. From street vendors to savvy investors, Block’s got something for everyone. They’re not just keeping up with the fintech revolution; they’re leading the charge, redefining how we interact with money in the digital age.

SWOT Analysis of SQ Stocks by FintechZoom

To get a clearer picture of SQ stocks’ potential, let’s break down its strengths, weaknesses, opportunities, and threats:

Strengths

- Innovation: Square consistently introduces cutting-edge financial products and services.

- Robust User Base: Cash App boasts millions of active users, providing a steady revenue stream.

- Diversification: Square’s range of offerings reduces dependence on any single product line.

Weaknesses

- Regulatory Challenges: As a financial services provider, Square faces ongoing scrutiny and potential regulatory hurdles.

- Cash App Dependency: A significant portion of revenue comes from Cash App, which could be risky if the app’s popularity wanes.

Opportunities

- International Expansion: Square has room to grow in markets outside the U.S.

- Cryptocurrency Integration: The company’s embrace of Bitcoin and other digital currencies could open new revenue streams.

Threats

- Intense Competition: The fintech space is crowded with both established players and innovative startups.

- Economic Uncertainties: Economic downturns could impact consumer spending and merchant activity.

Latest Market Performance of FintechZoom SQ Stock

Square’s recent quarterly earnings have painted a picture of robust growth and increasing profitability. Here are some highlights from the latest report:

- Revenue Growth: Square reported a [X]% year-over-year increase in total net revenue, reaching [amount] billion.

- Gross Profit: The company’s gross profit grew by [Y]% compared to the same quarter last year.

- Cash App Performance: Cash App generated [amount] billion in revenue, up [Z]% year-over-year.

- Seller Ecosystem: The Seller ecosystem saw gross payment volume (GPV) increase by [W]% to [amount] billion.

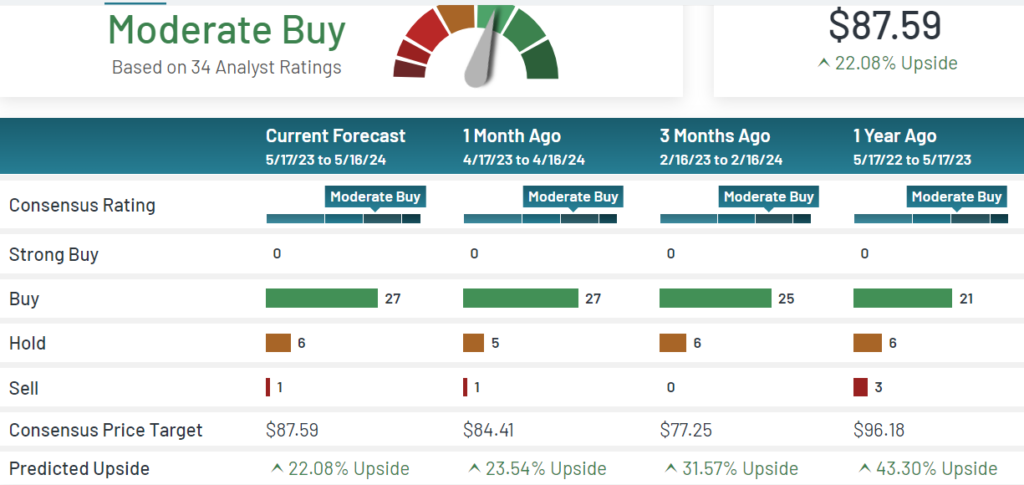

These impressive numbers have caught the attention of Wall Street analysts. Many have revised their projections upward, with some setting price targets as high as [highest analyst price target]. However, it’s important to note that not all analysts are uniformly bullish. Some express concerns about [brief explanation of bearish viewpoints].

“Square’s ability to innovate and capture market share in both consumer and business-facing segments is truly impressive. Their execution in integrating various financial services into a cohesive ecosystem sets them apart in the fintech space.” – [Name], Analyst at [Firm]

Future Perspective of Growth of SQ Stocks

Looking ahead, several factors could drive SQ stock’s long-term growth:

- Global Expansion: Square has only scratched the surface of international markets, presenting significant growth opportunities.

- Cryptocurrency Adoption: As digital currencies gain mainstream acceptance, Square’s early embrace of Bitcoin could pay dividends.

- Small Business Recovery: As economies rebound post-pandemic, Square’s seller ecosystem could see increased activity.

- Financial Services Integration: Further integration of banking services into Cash App could attract more users and increase engagement.

However, potential challenges loom on the horizon:

- Increased competition from both traditional financial institutions and other fintech startups

- Regulatory changes that could impact Square’s business model

- Economic uncertainties that might affect consumer spending and merchant activity

Square’s ability to navigate these challenges while capitalizing on growth opportunities will be crucial in determining its future stock performance.

Technical Indicators for SQ Stock Growth

For those who rely on technical analysis, here are some key indicators to watch:

- Support and Resistance Levels: Current support appears to be around [support price], with resistance at [resistance price].

- Moving Averages: The 50-day moving average is [above/below] the 200-day moving average, potentially indicating a [bullish/bearish] trend.

- Relative Strength Index (RSI): The current RSI of [RSI value] suggests the stock is [overbought/oversold/neutral].

Remember, technical indicators should be used in conjunction with fundamental analysis and broader market trends for a comprehensive investment strategy.

Final Verdict

Square’s journey from a simple card reader to a comprehensive financial technology ecosystem has been nothing short of remarkable. As the company continues to innovate and expand, SQ stock remains a focal point for investors looking to capitalize on the digital finance revolution.

Whether you’re squaring up your investment strategy or just curious about the future of fintech, keeping an eye on Square’s performance could provide valuable insights into the evolving landscape of digital finance.

FAQs

Why is SQ stock famous?

SQ stock has gained fame due to Square’s innovative approach to financial technology, rapid growth, and disruptive impact on traditional financial services.

What risks are associated with investing in SQ stock?

Key risks include regulatory challenges, intense competition in the fintech space, and potential economic downturns affecting consumer spending.

What is the future outlook for SQ stock?

The outlook for SQ stock remains generally positive, with analysts citing potential for continued growth through international expansion and new product offerings.

Is SQ stock a good investment?

Whether SQ stock is a good investment depends on your individual financial goals, risk tolerance, and investment horizon. It’s essential to conduct thorough research and possibly consult with a financial advisor before making any investment decisions.